Written by MarketBeat Staff

August 12, 2022

A dividend is a portion of a company’s profit paid back to shareholders. In most cases, companies that issue a dividend are financially stable. Many of these companies are in mature industries and have predictable revenue and earnings. Utility stocks and consumer discretionary stocks are good examples of companies that traditionally pay dividends.

Although dividend stocks are traditionally lumped into the "value" category, many of these companies can generate significant capital growth, particularly during a bull market. One of the distinctions is the ability of these companies to pay a dividend in a bear market. This can be considered a kind of reward for investors who may otherwise not see a lot of growth.

As an investor, you can choose from many dividend stocks. One way to compare companies involves looking at dividend yield. Our dividend calculator can help you calculate the dividend yield of your stock investments, but before you make your final investment decisions, it's important to understand the comprehensive meaning of the dividend yield. In this article, we’ll review the definition of dividend yield and explain how to calculate it. More importantly, we'll also review why bigger is not always better.

What is Dividend Yield?

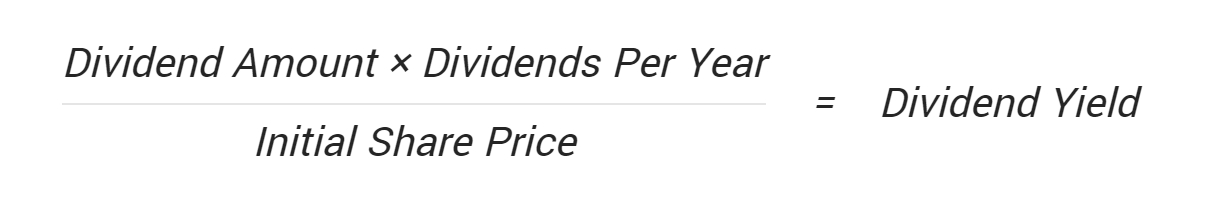

Dividend yield is a calculation of the amount (in dollars) of a company’s current annual dividend per share divided by its current stock price:

Dividend Yield = Current Annual Dividend Per Share/Current Stock Price

Here's an example: Let's say Company A pays $2 in dividends on an annual basis with a stock price of $60. In this case, it has a dividend yield of 3.33%. It’s that simple. However, in that formula, there is a lot of room for variance, which could affect how an investor should feel about a particular dividend.

You can find the current annual dividend and the current stock price on MarketBeat by typing in the ticker symbol of the stocks you're considering adding to your portfolio.

The key word on both sides of the equation is “current”. A dividend yield is very fluid, and although a company has very little control over its stock price on a given day, it has complete control over its dividend.

Companies typically pay dividends quarterly (four times per year) or annually (once per year). When a company delivers its earnings report to shareholders, it usually provides guidance about the direction of the dividend.

If the company expects that it will have earnings and revenue growth, it may project a dividend increase. If the company expects slow and/or declining earnings and revenue, it may project keeping the dividend the same. In extreme economic downturns such as the financial crisis of 2007-2008 during the COVID-19 pandemic, companies chose to drastically cut or briefly suspend their dividends.

It's important to note that not all companies pay out dividends. For example, growth companies might not pay out any dividends at all because they can create more value by reinvesting their earnings back into their fledgling business.

Is a Higher Dividend Yield Always Better?

At first glance, you might think a higher dividend is better. But the answer is a little more murky — in some cases, yes, it's better, and in some cases, it isn't.

Let’s say an investor is comparing two companies within the same sector, such as two utility stocks, for example. If everything else is relatively equal between the companies, then it’s reasonable to presume that the company with a higher dividend yield is a better investment. But to check if the presumption is correct, investors need to look at both sides of the calculation.

If you're looking for an exact percentage as a guideline, look for dividend yields between 2% to 4%. Anything above 4% may either be a great purchase or a risky buy.

How Does Stock Price Affect Dividend Yield?

First let’s talk about the company’s stock price.

In our example above, Company A has a dividend yield of 3.33% based on an annual dividend of $2 per share and a share price of $60 per share. Let’s say you want to compare that company with Company B, which is paying $1.50 per share annually as a dividend. This company has a stock price of $50 with a yield of 3%.

Company A’s share price rises to $69 per share, the dividend yield will drop to 2.8%. Does this mean that it’s now better to buy shares of Company B? Not necessarily. In fact, if Company B’s stock price hasn’t moved over the course of a year, and Company A’s stock price has increased by 15%, the better investment for total return will be Company A.

How Does Dividend Per Share Affect Dividend Yield?

Let's go back to our example in which Company A has a dividend yield of 2.8%. What if Company B’s stock price did not change? Let's say Company B was able to increase its annual dividend from $1.50 to $1.75 to achieve a dividend yield of 3.5%.

This means that as an investor, you would have to look at other factors to decide which company’s stock is better to own. For example, analysts might project that Company A will raise its dividend later in the year. That would mean that the difference in yield between Company’s A and B may be insignificant.

The examples above were given simply to help you understand that a dividend yield is very fluid and can change daily based on factors outside of the company’s control. One thing that can help shape your perception of a company’s dividend yield is its historical yield.

Once a company starts to issue a dividend, they will usually give it a high priority. This is because once investors expect a dividend, cutting it or suspending it (aside from extreme circumstances) may mean that investors could question the health of the company.

Beware of the Yield Trap

A dividend yield trap occurs when the stock of a company falls faster than its earnings and makes its yield look more attractive than it really is.

Here’s why it’s a trap: Let’s say you buy the stock at its low price and then the company cuts its dividend. Investors may start to sell off even more, lowering the share price, which means you’ve lost capital growth and will see a lower yield.

This is not the company's fault. However, in rare cases (although maybe not as rare as they should be), a financially troubled company will deliberately try to jack up its yield so that investors will buy the stock.

Dividend Payout Ratio is Equally Important

In addition to looking at a company’s dividend yield, many investors will also look at a company's dividend payout ratio. The payout ratio is the amount of a company’s net income that goes toward dividends. Analysts will examine a company’s payout ratio based on one or more of the following metrics:

- Trailing 12 months of earnings (TTM)

- Current year’s earnings estimates

- Next year’s earnings estimates

- Cash flow

Like the company’s dividend yield, a good payout ratio depends on many factors, one of which is the sector in which a company performs. If one company’s payout ratio is significantly higher or lower than another company’s in the same sector, it merits further investigation.

The Bottom Line on Dividend Yield

In general, when a company pays a dividend, analysts consider that to be an indication that the company has good fundamentals. In good (and sometimes rough) economic conditions, these companies have solid balance sheets. That’s because many of these companies are in defensive industries, which means that demand for its products are generally stable regardless of market conditions.

When a company increases its annual dividend for at least 25 consecutive years, it becomes part of a club known as the Dividend Aristocrats. These companies are generally considered safe investments because they can issue regular dividends in both good and bad financial conditions.

Before you make your investment decisions, it's a good idea to do your own research. High dividend stocks may not be able to sustain the high dividends that investors collect. As we’ve shown, you must look at dividend yield in light of a company’s total financial picture. A company may cut its dividend in order to pay off some long-term debt or shut down nonprofitable parts of its business. In this case, a dividend may be a prudent move.