If you want to maximize your returns and take advantage of the benefits of dividend increases, the key is to know how to capture the value they can bring. While not every company will offer dividends, many companies do, which can help your portfolio grow over time, especially when dividends increase.

In this article, we’ll discuss the various ways you can capture the benefits of dividend increases, and we’ll talk about what to be aware of when picking stocks for long-term dividend growth.

With the right tools and knowledge, you can use dividend increases to build your portfolio. By understanding how to leverage dividend increases, you can build wealth and create a secure financial future.

What Are Dividend Increases?

Dividend increases are when a company’s board of directors chooses to raise the amount of dividends that shareholders receive in cash or through stock repurchases. Dividend increases today can help you capture the benefits of long-term growth as well as provide you with a steady stream of income. Dividend yields also tend to increase with dividend increases, since companies are willing to pay more for shareholders’ loyalty.

Why Do Companies Increase Dividends?

The urge to increase dividend yields is strong. Companies find themselves in a tug-of-war between reinvesting their profits into capital projects and leaving more available for shareholders. So a decision for a dividend increase often reflects a change in their strategy, as well as a drive to attract more equity investors. Meanwhile, as net profits continue to rise, it creates an ever-increasing pot of money to be distributed to loyal shareholders.

Companies often increase their dividends when there is a strong outlook for the company's future. For example, Bank of America (NYSE: BAC) increased its dividend in 2019 after analysts predicted that the financial services provider would benefit from an improving economy and higher interest rates. In addition to increasing its dividend, Bank of America also increased its stock buyback program by $31 billion as an additional reward for shareholders. Similarly, JPMorgan Chase & Co. (NYSE: JPM) raised its quarterly dividend in 2021, acknowledging that it had achieved impressive profits during the previous year and was well-positioned to continue growing in the future. These examples of recent dividend increases show how companies can use dividend increases to demonstrate confidence in their long-term prospects and create value for shareholders.

Understanding Dividend Yield and Dividend Payout Ratio

As an investor looking to benefit from upcoming dividend increases, one of your first steps should be to understand the concepts of dividend yield and dividend payout ratio.

Dividend Yield

The dividend yield is a measure of the income you as an investor can get from a stock, represented as a percentage. Here's an example to help you understand it better: let's say Company A has an annual dividend of $2 per share and its stock is priced at $40 per share. For Company B, the annual dividend is only $1 per share, but their shares are still worth $40 each.

To calculate their yields, we just divide the per-share dividend by the price. That would mean Company A has a 5 percent yield ($2 divided by $40), while Company B would be 2.5%.

That means if you were to invest $10,000 into either company, Company A will give back $500 in annual dividends whereas Company B will give you back only $250. So if all other things are equal, if you're looking for income, you should choose Company A due to its higher yield.

MarketBeat provides a calculator to calculate each stock's dividend yield (for example, JPM, below) and compare them. Click on "dividends" and then "open in dividend yield calculator."

Dividend Payout Ratio

The dividend payout ratio (also known as the payout ratio) tells you how much of a company's profit is being returned to shareholders, rather than kept on hand for reinvestment. The equation to figure this out is: Dividends Paid / Net Income. Some companies give all their profits back to shareholders. Generally, more established companies have higher payout ratios. MarketBeat provides dividend payout ratios on each stock's page under "dividends" (see below for JPM).

Which Companies Increase Dividends?

When looking for companies that increase dividends, it's important to look for those with a track record of consistently increasing their payout. This generally means the company has been performing well and generating enough profits to maintain or even increase its dividend payments. Here we'll look at three key groups in the stock market that have impressive histories of increasing dividends.

Dividend Princes

A Dividend Prince is a company that has increased its dividend for at least 10 consecutive years. These companies are typically mature companies in sectors like utilities, consumer staples, healthcare and telecommunications. Choosing these can provide stability to your portfolio along with steady income.

Dividend Aristocrats

A Dividend Aristocrat is a company that has increased its dividend payments for at least 25 consecutive years. These are usually more established companies with more consistent earnings growth and higher dividend yields than the average stock on the market.

Dividend Kings

A Dividend King is a company that has raised its dividend payment each year for 50 consecutive years or more – an impressive feat for any business. These organizations usually have wide moats protecting them from competition, financial soundness and proven management teams that continuously add value.

How Dividend Increases Benefit Your Portfolio

When companies increase their dividend, it's usually a sign that their earnings are growing and the company is in a financially solid position. As an investor, this means you get more of the profits each quarter without having to worry about market fluctuations or erosion due to inflation. Additionally, steady dividend increases can help build up your cash flow over time – meaning you have more money available for future investments and purchases.

And when well-established companies with strong track records of performance (such as those mentioned earlier) increase their dividends, they often become "blue chip" stocks — companies whose share prices tend to outperform many others on the index over the long term.

How to Invest in Stocks with Increasing Dividends

When companies declare their latest dividend increases, you need to understand what this means and how to take full advantage of it. Below, we've assembled some of the most common techniques smart investors use.

Reinvest Your Dividends

When a company declares an increase in its dividend, the simplest way to capture the benefits is by reinvesting the dividends back into the stock. This way, you can build your position over time and benefit from compounding returns, which can be significant. Many, but not all, dividend-paying companies allow you to reinvest dividends through a dividend reinvestment plan (DRIP). Automatic reinvestment is a strategy for those who don't need the regular income generated by dividends.

Dividend reinvestment plans (DRIPs) allow you to automatically reinvest dividends. For example, if you buy 100 shares of Company XYZ at $25 per share with a dividend yield of 5 percent, you'll earn a yearly dividend of $125, and on a DRIP, purchase an additional five shares of the company's stock. If the share price rises by the end of the year, the 105 shares will now be worth more than the original investment. Some companies also allow you to make additional investments at market or discounted prices.

Focus on Dividend Growth Stocks

Another way to use MarketBeat dividend increases is by focusing on dividend growth stocks, or stocks with consistently increasing dividends over time. Companies that regularly raise their dividends are often stable and reliable businesses that have proven track records of consistently delivering value to shareholders.

Dividend Mutual Funds and ETFs

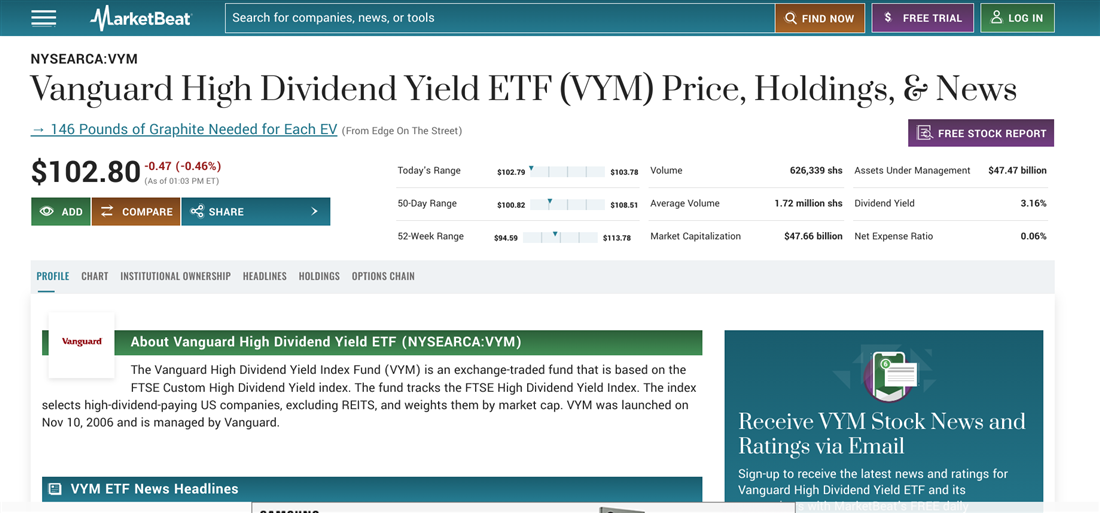

Investing in a dividend mutual fund or exchange-traded fund (ETF) can be a good option for beginner investors. These funds typically comprise multiple stocks, so you're not putting all your eggs in one basket. Some of the most popular dividend ETFs include the Vanguard High Dividend Yield ETF (NYSEARCA: VYM) and Schwab US Dividend Equity ETF (NYSEARCA: SCHD).

However, you still need to choose the right fund. Look at the stocks included and check their dividend yield, consistency with paying the dividend and their market capitalization, which is their share price multiplied by the number of outstanding shares. Also check the fund's expense ratio, or how much of its assets go towards administrative and operating expenses.

Check MarketBeat for this information (for example, VYM, below).

Beware of Chasing a Dividend Yield

Dividend-hungry investors, beware: a high dividend yield can sometimes be your undoing. While some companies truly have strong fundamentals that support high yields, sometimes it’s a trap. To avoid getting stuck, always look at the company's fundamentals and see if the dividend is sustainable. If you want to maximize your profits without sacrificing safety, search for companies with a track record of steadily increasing yields.

Dividend Increases: Adding Value

You likely now understand what it means when companies make increased dividend announcements, and how to take full advantage of them. Focusing on dividend growth stocks can also help capture more value than static dividend payers. Remember, look at the overall yield rather than just the current rate. With careful analysis, investing in stocks with increasing dividends can be a prime way to generate consistent returns in the long run.

FAQs

Do you still have questions about how to benefit from dividend increases? Here are some answers to frequently asked questions about how companies add value by increasing their payouts to shareholders.

What does it mean when dividends increase?

It means that the company is paying out more money to shareholders than before. This could be a result of increased profits, or simply an attempt to make the stock more attractive to potential investors. Generally, when dividends increase, so does the value of the stock for its existing holders, but keep in mind that dividend increases aren't always an indication of strong financial health. They could be a sign that the company is dealing with financial difficulties and trying to attract new investors by offering higher yields.

Why is increasing dividends a good thing?

Increasing dividends can be an ideal way for companies to reward shareholders and incentivize them to remain invested long-term. It can also indicate financial strength. Dividend growth stocks often outperform other investments, as they provide consistent returns over time, and can help capture more value in the form of compounding returns.

How often do companies raise dividends?

The frequency of dividend increases varies depending on the company. Generally, as a company grows and makes more cash, it can pay out larger dividends or increase them at a faster rate. Companies that consistently perform well over time may choose to increase dividends every year or even quarterly. On the other hand, some companies prefer to keep their dividends static or only increase them in years when their profits are high. Ultimately, it's up to the board of directors to decide whether or not to raise the dividend payout.