However, decisions on how to invest in green energy remain murky as the industry is slow to improve efficiency and reliance on traditional fuel sources is still high. Investors should be aware of both benefits and drawbacks of green energy and understand the timelines laid out by the top renewable energy stocks.

Overview of Renewable Energy Investments

Energy production and environmental concerns have been clashing in some form or another for centuries. Many of the energy sources we depend on daily aren’t just harmful to the environment but can cause health problems in those working in the industries. Oil, coal, gas and other fossil fuels might be abundant and easily converted to electricity, but the pros and cons are becoming more intensely debated.

For example, coal mining can be efficient and affordable, but miners are subject to hazards like roof collapses, burns, inhalation of toxic chemicals and consumption of contaminated water. Coal mining also harms local habitats, and consumption contributes to pollution. Not to pick on the coal industry, but most traditional energy sources require heavy processes for mining and extraction, which will always have negative externalities for the surrounding environment.

The renewable energy industry wants to remove some negative outcomes by creating power sources that don’t harm the environment when mined or consumed. Wind, solar and hydroelectric power are three of the biggest sources for companies investing in renewable energy, but they aren’t the only ones. Even legacy oil and gas companies like Exxon Mobil Corp. (NYSE: XOM) and Chevron Corp. (NYSE: CVX) have committed billions of dollars to clean energy improvements and initiatives.

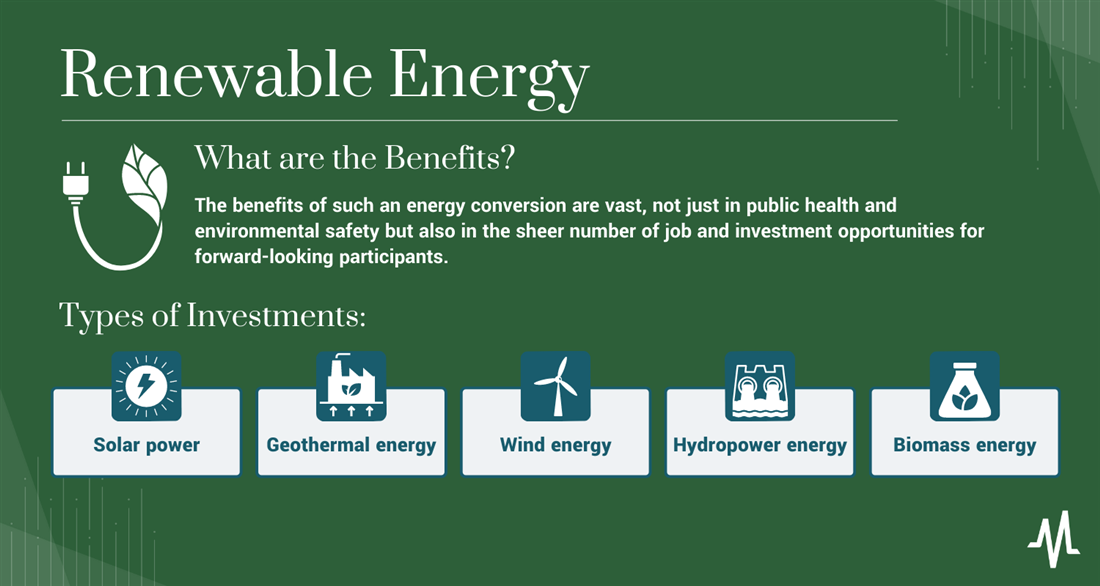

Types of Renewable Energy Investments

The U.S. Energy Information Administration (EIA) lists the following as the five main types of renewable energy. Companies involved in green energy production are likely researching and developing one of these five power generation sources.

Solar Power

Companies investing in solar energy attempt to harness the sun’s rays through panels using photovoltaic cells. These cells capture sunlight and convert it directly to electricity. Large cells can be powerful enough to supply entire homes or buildings with energy without giving off pollutants. Some companies directly investing in solar technology include SolarEdge Technologies Inc. (NASDAQ: SEDG), Enphase Energy Inc. (NASDAQ: ENPH) and Canadian Solar Inc. (NASDAQ: CSIQ).

Geothermal Energy

One of the least discussed forms of renewable energy is the geothermal kind, which is produced by heat coming from underground. Even the Earth’s mantle (the outermost of the planet’s four layers) produces tremendous heat harnessed and turned into electricity. Geothermal energy projects are underway at companies like Eversource Energy (NYSE: ES) and Ormat Technologies Inc. (NYSE: ORA).

Wind Energy

Air heats at different rates depending on whether it’s above land or water. Wind occurs when warm air rises and heavier and cooler air replaces it. Wind creates a potentially unlimited energy source that turbines can harness as long as the sun continues to shine. Clearway Energy Inc. (NYSE: CWEN) and NextEra Energy Inc. (NYSE: NEE) are companies with large investments in wind energy solutions.

Hydropower Energy

If you’ve ever seen the Hoover Dam, you’ve seen an example of hydroelectric power. Hydropower is one of the oldest forms of energy production, used in industrial production as far back as 1880. Hydropower comes from turbines in a moving body of water or through storage systems like reservoirs and dams. You can find hydropower systems divisions at Ocean Power Technologies Inc. (NASDAQ: OPTT) and IDACORP Inc. (NYSE: IDA).

Biomass Energy

Biomass refers to organic materials like wood, plants, manure or even sewage that can convert into energy through several conversion processes. Brookfield Renewable Partners LP (NYSE: BEP) is one example of a clean energy stock with a biomass division.

Offshoots of the renewable industry could include companies that manufacture batteries and other infrastructure, like Panasonic Holdings Corp (OTC: PCRFY) and Samsung Electronics Co. Ltd. (OTC: SSNLF), along with electric vehicle manufacturers like Tesla Motors Inc. (NASDAQ: TSLA) and NIO Inc. (NYSE: NIO).

What about nuclear energy? While nuclear power is more efficient than fossil fuels (and most renewable sources), it’s created through uranium which cannot be reused. The global uranium supply is also finite; therefore, it is not a renewable energy source.

How to Invest in Renewable Energy

Planning to invest in renewable energy? Follow this five-step guide to add clean energy stocks to your portfolio.

Step 1: Determine the types of energy to invest in.

Not only renewable energy companies focus on the same things - some are devoted to solar, others to wind and hydroelectric power. You’ll need to decide which areas of the renewables sector have the most promise, or you can buy the whole industry with an ETF like the iShares Clean Energy Global ETF (NYSE: ICLN).

Step 2: Decide your investment parameters and research companies.

What’s the planned scope of your renewable energy investments? Are you planning to invest for years or decades as incremental progress occurs, or are you trying to pick winners in areas like solar or wind? Develop investment parameters and research the stocks or ETFs that fit your criteria.

Step 3: Set aside capital for renewable energy investments.

How much capital do you plan on devoting to clean energy stocks? While sustainable energy is a goal that governments, companies and citizens all share, the path to getting there won’t be straight and narrow. You’ll need to assess your personal risk tolerance and investment goals when deciding how much capital to put toward these stocks.

Step 4: Purchase shares and build your positions.

Once you’ve established an investment plan and researched your ideal companies, you must purchase shares and build your positions. You could buy all your desired investments at once or ease into them over time by buying shares periodically. The choice is yours, as green energy stocks are more volatile and unpredictable than their traditional peers.

Step 5: Monitor your investments and keep up with current events.

Checking your portfolio daily is usually a bad idea since it leads to overtrading, but you should carefully monitor your investments in green energy companies. You must keep up to date with companies’ reports and guidance and stay abreast of political and economic developments that could push green energy investments forward (or backward).

Pros and Cons of Investing in Renewable Energy

No guide on how to invest in renewables is complete without paying down the pros and cons of the green energy revolution. The benefits are exciting, but the drawbacks also must be considered if we want a smooth transition from fossil fuels to clean energy sources.

Pros

First, the benefits of investing in renewable energy:

- Regulatory headwinds: Governments around the world are incentivizing green energy production. In the United States, the Inflation Reduction Act of 2022 has several addendums on renewables, such as providing billions in grant money for state initiatives and tax credits for producing solar panels, wind turbines and biofuels.

- Sustainability: Renewable energy comes from sources that won’t dry up in the future, like sunlight, wind and geothermal heat. The unlimited potential of these resources can create economic stability and reduce the reliance on foreign fuel sources.

- Improved health outcomes: Not only are renewable energy sources sustainable and better for the environment, but pollution reduction would create positive health outcomes for all Americans. Air pollution, while improving dramatically since 1990, still contributes to around 60,000 annual deaths in the United States as of 2019.

Cons

The downsides of investing in renewable energy include the following:

- Efficiency: Many of these energy sources are relatively new compared to the centuries-old fossil fuel extraction processes. As a result, getting maximum efficiency from solar panels, wind turbines and hydroelectric facilities has been slow going. For example, solar panels are estimated to convert only 27% of possible sunlight into usable energy. And not only is the equipment inefficient, but storage is another concern as sunlight and wind are intermittent and cannot be harnessed 24/7.

- Upfront costs: Investing in renewable energy will also require plenty of upfront costs. New infrastructure and improvements in efficiency and storage can prevent costs from spiraling out of control.

- Waste products: Sunlight and wind may not produce waste, but equipment breaks down, facilities need maintenance, and even the best rechargeable batteries eventually require disposal. Battery disposal is arguably the largest environmental concern created by transitions to clean energy since the process is still relatively inefficient. This is one of the reasons lithium stocks have become a hot investment item in 2023 as battery makers seek to improve shelf life and reduce waste.

Future of Renewable Energy

The best renewable energy stocks will play a large role in our future, but the timeline for reaching that future is vague. Many countries (including the U.S.) have called for a meaningful reduction in carbon emissions between 2030 and 2050. Legislation has carved out plenty of tax credits and grants for electric vehicle fleets, solar panels and hydro and wind power turbines.

But will we ever relinquish our need for fossil fuels? The Biden administration has set a goal of net zero carbon emissions by 2050, but that doesn’t mean that oil and gas will be completely forgotten. The EIA has stated that fossil fuels will still be a major power source for homes and vehicles in 2050 unless further legislation occurs.

Weigh the Risk and Rewards of Renewable Energy Stocks

Staying neutral about renewable energy stocks can be tricky. While the prospects of sustainable and endless energy are tantalizing, the world remains dependent on fossil fuels. And while oil and gas have finite reserves, we aren’t expected to run them dry anytime soon.

The future will likely involve a combination of green energy firms and traditional fossil fuel energy companies as mining and pollution reduction improvements continue to accelerate. Investors looking for a clear roadmap of future energy production will be disappointed to find an outlook still hazy and unpredictable.

No doubt renewables will play a major role in years to come, but how much that change benefits investors remains to be seen, though they may never end up on an ESG stocks list.

FAQs

Here are a few questions investors looking into the top renewable energy stocks may have:

Right now, solar and wind energy are the focus of a large majority of companies focused on renewables. However, hydroelectric power is beginning to gain a share in the market as companies explore different avenues of clean energy production.

Is renewable energy a good investment?

Renewable energy has several advantages over traditional fossil fuels and other nonrenewable sources, but the industry is still in its relative infancy, and advances may move slower than anticipated. All investments involve risk, and renewable energy stocks might not pay off until processes become more efficient and infrastructure gets implemented.