The metaverse is a virtual world that's quickly gaining popularity and investing in companies attempting to realize it may be a viable strategy.

In this article, we'll discuss what the metaverse definition, how to buy stock in metaverse, how it works and where to buy metaverse stocks. We'll also touch on the pros and cons of these companies and then walk you through how to buy stock in the metaverse step by step.

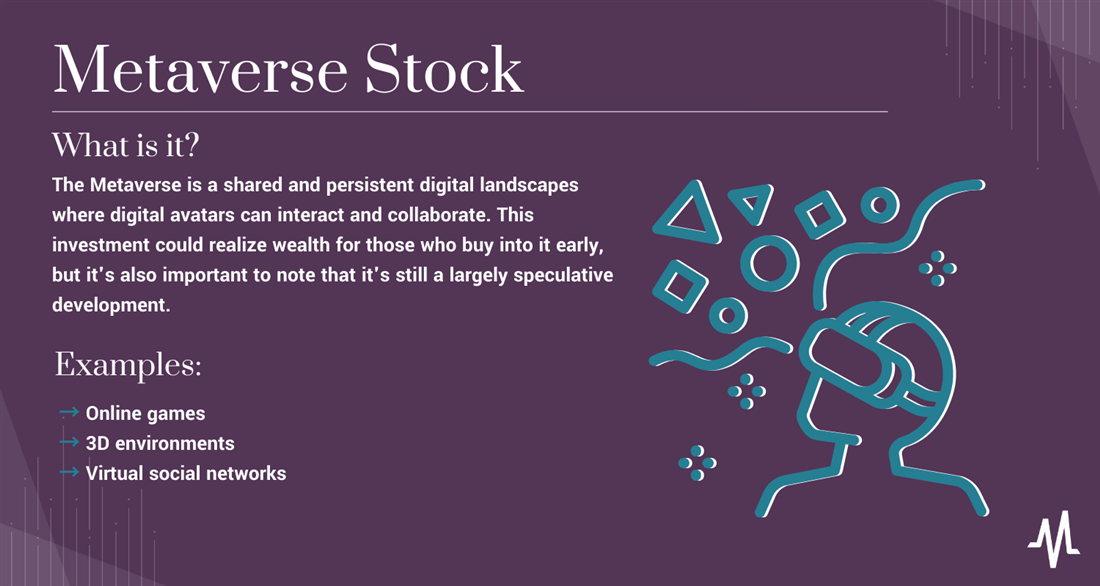

The metaverse is one of the critical buzzwords used in the technology investing space. In summary, the metaverse refers to shared and persistent digital landscapes where digital avatars can interact and collaborate. Some examples of the metaverse include online games, immersive, 3D environments and virtual social networks. Meta Platforms Inc. (NASDAQ: META), formerly known as Facebook, is the pioneer in this space, attempting to make a tremendous leap toward its realization. Read more about the metaverse.

Proponents of the metaverse state that people's lives will split between the real world and this virtual reality, and those who embrace it will take it very seriously. For instance, people can own digital assets that may appreciate within an independent ecosystem, which extends to owning real estate that can be leased and traded with other users. Online relationships and romances can occur, and new civilizations established and made immersive through virtual reality gear that puts the user directly inside these digital worlds.

The first iterations of the metaverse may have taken place with multiplayer games such as World of Warcraft and Second Life, both of which allowed users to claim persistent identities in an alternate universe. The emerging metaverse is aimed to be taken far more seriously and will have real-world implications for these platforms' investors, companies and users.

Investors might be wondering, can I invest in the metaverse? And the answer is yes, one way being through buying metaverse stocks.

First, to answer the question: "What are metaverse stocks?" These companies encompass various industries, such as virtual and augmented reality and 3D platforms. One thing they have in common is that they aim to help inject users into shared and persistent digital environments.

To further answer the question of what is a metaverse stock, here are some examples. Nvidia Corporation (NASDAQ: NVDA) chips power the graphics and physics engines that allow metaverse worlds to come to life. Microsoft Corporation (NASDAQ: MSFT) is another notable mention, as it seeks to partner with Meta to bring its software and apps to Meta's Quest VR headsets.

Another option to consider adding to your portfolio is Unity Software Inc. (NYSE: U), which provides a graphics and physics engine used primarily for gaming in and outside the metaverse. A glance at the listed companies will conclude that they are considered stable blue-chip stocks. Discover more about how to identify blue chip stocks.

Here are some pros and cons of investing in metaverse stocks to keep in mind to help you answer, "Should I invest in metaverse?"

Pros

Here are some pros or advantages of investing in metaverse stocks:

- High growth potential: Metaverse stocks are growth stocks because they have high potential returns. The metaverse is still developing, so there is much room for this to become a reality.

- Diversified investment: Buying shares in metaverse stocks could allow you to gain exposure to an emerging industry, thus diversifying your portfolio against potential losses from being overweight in a particular sector.

- Growing market: The metaverse is still a speculative bet, but if analyst forecasts are correct, then it could quickly expand in size to 1.3 trillion by 2030, potentially leading you to reap healthy returns.

Cons

Despite the attractiveness of the metaverse, there are some downsides to watch out for before buying metaverse stocks:

- Uncertain future: The metaverse's high growth potential comes with a corresponding risk. The metaverse may take off or fail spectacularly.

- Lack of information: Owing to the metaverse's uncertainty is a lack of information and resources around it for investors to make an informed estimation about its future. The industry is still in its infancy, and it might be too early to determine its overall impact.

- Volatility: Metaverse stocks exist in the technology sector, known for being cyclical and volatile. Smaller metaverse stocks with limited operating histories will likely spring up and may invite more risk.

This section will explain how you can metaverse stocks step by step.

Step 1: Research your stocks.

There's no shortage of stocks you can choose from attempting to realize the metaverse. For example, you can invest in metaverse platforms by buying shares of companies like Meta or, instead, invest in companies that provide the underlying technologies and hardware, like Nvidia or Microsoft. Whichever company you choose, you must do your due diligence by analyzing the stock's financials, management team, competitive positioning and valuation.

Step 2: Create a watchlist.

It's uncommon for the metaverse stocks on your list to offer competitive pricing at first glance. For this reason, many investors choose to create a watchlist of stocks they are interested in buying first instead of jumping in headfirst and buying them. By creating a watchlist of metaverse stocks, you can wait for their share prices to dip and potentially reap higher returns later.

Step 3: Size your positions.

If your intended stock has fallen in price, one popular method for accumulating more shares at a cheaper price is to use the dollar-cost average method. Instead of buying all the shares immediately, you may dollar-cost average into the stock over weeks or months and potentially reap a lower cost basis overall.

Also, consider whether you'd like to split your positions between numerous metaverse stocks or focus on one company. Evening out your investment over multiple firms may give you the benefits of diversification, but you may also miss out on realizing the full value catalysts of singular firms.

Step 4: Buy the shares.

The last step is placing orders through your broker or stock trading account. If you still need to open an account, it's important to read through reviews posted online about these platforms and consider which brands suit your investment needs. Some trading accounts are tailored toward more advanced traders and offer sophisticated options and futures markets. In contrast, others like Robinhood are more suited to those who like to buy and hold.

Step 5: Monitor your investments.

The last step is to monitor your metaverse stocks through portfolio tracking software. Most brokers will provide this information free of charge and you can easily access them under your profit and loss (P/L) statement section. Alternatively, you could create a spreadsheet in Google Sheets of your investments to keep track of them that way or purchase a third-party software application.

Exercise patience with your investments and avoid the temptations of being swayed by greed and fear, two of the most challenging obstacles investors face. These feelings may occur when you have a long-term investment horizon, such as realizing something as disruptive and speculative as the metaverse. Discipline, therefore, is vital, as well as sticking to your original investment thesis.

Besides buying metaverse stocks, other viable ways exist to gain exposure to this phenomenon. One way is purchasing non-fungible tokens (NFTs), which may hold a special place in many metaverse economies. You can read more about these assets on our NFTs, explained page.

NFTs today are sold on marketplaces such as Opensea and are typically pieces of non-fungible artwork, meaning they are minted uniquely and exclusive to the user. Note that anyone can start their own NFT collection and sell them; scams are rampant in the industry. NFTs can also include other digital assets, including video game items, music, videos and Web3 domain names. Buying these items gives investors exposure to the metaverse. You can also look at our list of best NFT stocks for additional investment ideas.

Expectedly, the medium of exchange in the metaverse is cryptocurrencies. The big coins all appear, such as bitcoin and Ethereum. Other coins belonging to different blockchains are also prominent, including Polygon, which offers a cheaper way to mint NFTs than Ethereum.

Finally, if you want broad diversified exposure to the metaverse, consider purchasing a metaverse exchange-traded fund (ETF). These funds invest in a basket of metaverse stocks. Some metaverse ETFs include the iShares Metaverse UCITS ETF (NASDAQ: MBB) as well as the Franklin Metaverse UCITS ETF (LON: METP) and the Proshares Metaverse ETF (NYSEARCA: VERS).

Whether you're bullish about the prospects of the metaverse unfolding as planned or not and still pondering "What is metaverse stock," what's undeniable is that the internet is changing and moving in a new direction. The metaverse could realize wealth for those who buy into it early, but it's also important to note that it's still a largely speculative development.

FAQs

Here are the answers to some of the most frequently asked questions about the metaverse.

Another way of phrasing this question might be, "Can you buy stock in the metaverse?" The answer is no. The metaverse sometimes describes how the internet is changing. Buying shares in the metaverse is impossible, but people can invest in companies attempting to build and realize it.

You can invest in the metaverse by buying shares in metaverse stocks or ETFs and indirectly through purchasing cryptocurrencies like Ethereum and Polygon. You may also buy NFTs like in-game collectible items and Web3 domains.

Now that you know the answer to "Can I invest in metaverse?" how much do shares cost? Shares of metaverse companies can range anywhere from a few dollars to a few thousand dollars, depending on market conditions.