Since being coined in 2013, a FAANG portfolio has vastly outperformed the S&P 500.

Do MATANA stocks have the same potential moving forward? In this article, we'll look at the six stocks comprising the MATANA tag and discuss the outlook for these exciting (but volatile) companies.

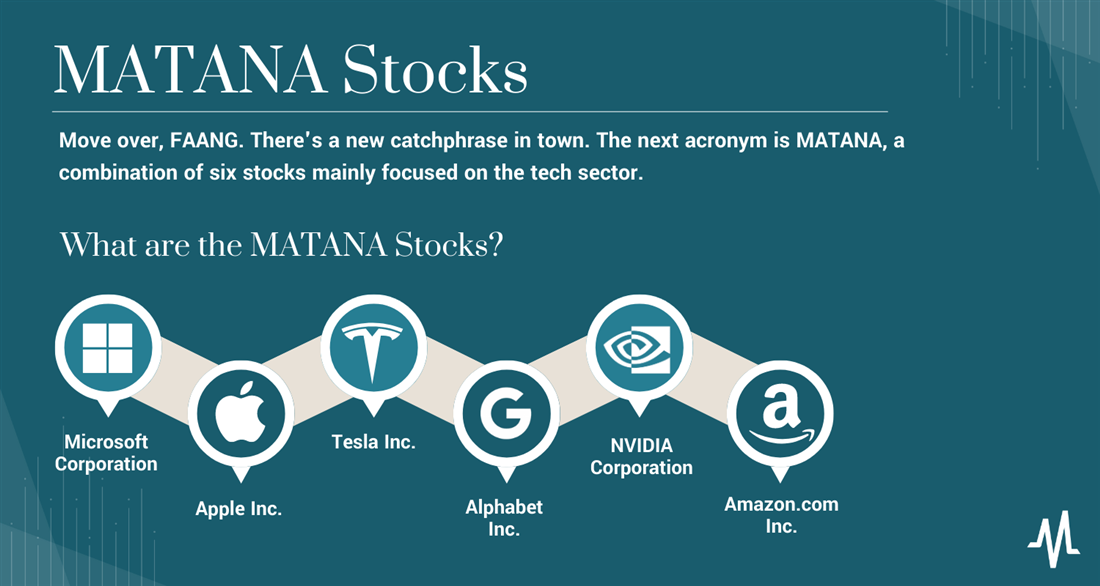

Overview of MATANA Stocks

In 2013, CNBC personality Jim Cramer created "FANG" for four tech stocks he thought were primed for massive growth — Facebook, Amazon, Netflix and Google.

Facebook had just gone public in 2012, but all four companies were rising to the top of the specific niche in the tech industry. Facebook was dominating social, Amazon.com Inc. (NASDAQ: AMZN) was becoming synonymous with e-commerce and Netflix, and Google had already become adjectives. In 2017, the acronym was expanded to include Apple Inc. (NASDAQ: AAPL) and became FAANG.

Between 2017 and 2022, the FAANG stocks were some of the market's biggest winners. Coupled with the Philadelphia Eagles' 2018 Super Bowl win, it was a tremendous five-year stretch for the much-maligned Cramer. If FAANG stocks were removed from the index, the S&P 500's 5-year annualized return during that time frame would drop from 15% to just 7%. However, the investing climate is different in 2023, and new acronyms have sprung up to supersede FAANG.

MATANA stocks consist of many repeats from the FAANG brood, but this acronym dumps Netflix Inc. (NASDAQ: NFLX) and Meta Platforms Inc. (NASDAQ: META) in favor of NVIDIA Corp. (NASDAQ: NVDA). Microsoft Inc. (NASDAQ: MSFT) and Tesla Inc. (NASDAQ: TSLA).

One such iteration is MATANA, which makes a few changes to the original FAANG lineup. Netflix and Facebook are out, but AI and electronics take a bigger role with the inclusion of NVIDIA, Microsoft and Tesla. MATANA also reflects the name change from Google to Alphabet Inc. (NASDAQ: GOOG).

Microsoft Corporation

Microsoft was left out of the original FAANG group because it was a laggard among large-cap tech names between the end of the Great Recession in 2009 and the genesis of FAANG in 2013.

But then CEO Satya Nadella kicked the company into high gear, and its stock began an impressive decade of outperformance. Between 2016 and its latest all-time high in 2022, the stock was up 700%. Today, Microsoft is a leader in two areas looking juicy to investors — the cloud and artificial intelligence. Combine these advances with the large moat Microsoft has built for its products and services, and the stock is a natural inclusion in any grouping of the biggest and most promising tech firms.

Apple Inc.

Regarding moats, few tech firms have built a larger one than Apple. While iPhone sales have been unsteady in the last few years, Apple remains arguably the most recognizable tech brand on the planet. In addition to iPhones, Macs and iPads, the company is now deeply involved in producing wearables like AirPods and the Apple Watch, along with services like Apple TV+, Apple Pay and smart devices like the HomePod. Like Microsoft, Apple's stock burst out of the doldrums in 2016 and gained over 500% until the 2022 tech bear market took hold.

Tesla Inc.

Tesla is the world's largest electric vehicle manufacturer, which initially seems odd in this tech-heavy stock grouping. But in addition to manufacturing EVs, Tesla has its hands in several other cookie jars thanks to innovative (and often mercurial) CEO Elon Musk. Tesla's energy generation and storage division develops and manufactures the Powerpack and Powerwall, lithium-ion battery storage solutions that use solar energy to fuel homes and businesses.

Alphabet Inc.

Google is still synonymous with search, and no one else is even coming close. Google's global search market share percentage was nearly 85% in January 2023, with Bing as the closest competitor at a measly 8.8%.

After rebranding as Alphabet Inc. in 2015, the company focused on three main divisions: Google Services, Google Cloud and Other Bets. Google Services is where you'll find the search business (and most of the company's revenue), along with YouTube and Google Home.

NVIDIA Corporation

Chip maker NVIDIA is the replacement for the streaming service Netflix, which has been losing market share and no longer has the fundamentals or future outlook to warrant a spot in a catchy acronym. Hardly a newcomer, NVIDIA has been a force in the computing world since its founding in 1993. NVIDIA graphics chips are at the heart of millions of gaming consoles and systems sold worldwide yearly and have been ever since Sega's Virtual Fighter in 1995. NVIDIA is also at the forefront of artificial intelligence and deep learning research. Claiming the "world's most advanced AI platform," the NVIDIA AI system can help businesses with training, analytics and cybersecurity.

One of the great investment success stories of the last decade has been Amazon, which has grown from an online bookseller to an e-commerce juggernaut. As of June 2022, Amazon has captured 37.8% of the global e-commerce market share, more than five times its closest competitor Walmart Inc. (NYSE: WMT).

But the true gem of the company is Amazon Web Services (AWS). AWS supplies cloud computing, analytics and data storage for thousands of different businesses, with recent research into machine learning and AI.

Why Invest in MATANA Stocks?

Investing in the six MATANA stocks isn't something that will appeal to everyone. Except for maybe Tesla, all firms in this group reside in the tech sector, making a MATANA portfolio very susceptible to volatility. While each company is a leader in its respective industry, the stocks tend to move up and down together, which may not fit the portfolio parameters of risk-averse investors.

So who does a MATANA stock appeal to? Risk-tolerant investors who don't mind a heavy concentration in the tech sector. An investment in MATANA is an investment in growth and innovation, often a bumpy ride but occasionally rewards investors handsomely. MATANA hopes to recreate the success of FAANG over the last decade. Still, investors should be aware the market environment now is much different than when FAANG stocks were producing eye-popping returns.

Is MATANA the New FAANG?

MATANA seems like a natural replacement to the FAANG stocks, which gave investors years of outsized gains following the IPO of Facebook in 2012. The FAANG stocks are:

- Facebook Inc. (Now Meta Platforms Inc.)

- Apple Inc.

- Amazon Inc.

- Netflix Inc.

- Google Inc. (Now Alphabet Inc.)

Is MATANA the new FAANG? In many ways, it's still the old FAANG — three of the original five companies remain firmly entrenched in the acronym. MATANA has expanded on the tech theme to include stalwarts like Microsoft and NVIDIA, plus relative newcomers like Tesla. So MATANA isn't exactly the new FAANG; it's a reboot for the next decade.

4 Ways to Invest in MATANA Stocks

The MATANA stocks are all large-cap companies with minimal dividends, so gains come from stock price appreciation. Consider this for tax purposes when considering which account to use for MATANA investments.

Invest in All Six Stocks Evenly

The easiest way to invest in MATANA is to simply buy evenly-weighted proportions of all six stocks in the group. An even-weight MATANA portfolio means each stock takes up 16.67% of the holdings. Whenever one holding gets too heavy, sell some shares and buy more of your lowest-weighted stock.

Apply Different Weights to MATANA Stocks in Your Portfolio

If you want to adjust your exposure, you can weigh each company differently in your portfolio. For example, if you're bullish on Amazon shares, you could make Amazon 30% of your holdings. If you think Tesla is overvalued, give those shares only 5% of your holding. Compare the stocks and adjust the percentages as you see fit based on your own goals and risk tolerances.

Select Stocks from the MATANA Acronym that Fit Your Goals

You don't need to invest in all six companies, either. Perhaps Elon Musk rubs you the wrong way, and you want to keep Tesla out of your portfolio. In that case, invest in the other five companies based on the abovementioned methods. There's no rule stating you must have all six MATANA stocks in your portfolio to be successful.

Invest in ETFs

Finally, since all 6 MATANA stocks are in the S&P 500, you can buy a large-cap index fund and get heavy exposure to these companies. For example, take the SDPR S&P 500 ETF Trust (NYSE: SPY). The MATANA stocks all have spots in the fund's top holdings.

Pros and Cons of Investing in MATANA Stocks

Before investing in this cohort of stocks, consider the benefits and drawbacks of including these companies in your portfolio:

Pros

The benefits of investing in MATANA stocks include:

- Industry leaders: The MATANA stocks are all large-cap companies with strong backgrounds, and in most cases, are the unquestioned leaders in their particular industry or field.

- History of outperformance: Some of the most impressive returns over the past decade have come from investments in these six companies.

- Innovative future: With expansion into AI, cloud computing, machine learning and autonomous driving, you may get guaranteed stock profits from MATANA, but you will get firms that seek to stay at the forefront of innovation into new technologies.

Cons

Here are some potential downsides:

- Heavy tech concentration: A MATANA portfolio lacks diversification. All six companies concentrate in tech, and high rates haven't always been friendly to tech firms.

- No dividends: You will receive little in terms of dividends from the MATANA stocks; most of your potential gains will come from stock price appreciation, which can make for some uneven quarters.

- High volatility: If you're risk-averse, this may not be your investment. To access great profits, you must be willing to handle stomach-churning declines, and all six stocks here have suffered multiple massive drawdowns.

Future of Investing in MATANA Stocks

Does MATANA mean no worries for the rest of your days?

Probably not. While the future is exciting for any company as deep into AI as these six firms, progress is rarely linear. Investors shouldn't expect a MATANA investment to smash the markets like FAANG stocks did over the last decade. Inflation is high, and rates are still rising, two factors that tech investors never wish for. An exciting future can still be murky, which inventors may have to deal with until conditions ease.

High Rates and Inflation Could Temper Returns

MATANA stocks could drive growth and innovation into the next decade, but high inflation and rising rates usually aren't kind to the tech sector. An investment in MATANA should be made with an eye on the long term.

If you need help with buy and sell decisions when markets are volatile, a narrow portfolio of six tech stocks could exacerbate the issue. Always assess your investment goals and risk tolerance before buying any security, especially ones with the volatility of MATANA.

FAQs

Here are some frequently asked questions about MATANA stocks:

What is the MATANA stock list?

The MATANA stocks differ from the traditional FAANG group. The list is as follows: Microsoft, Apple, Tesla, Amazon, NVIDIA and Alphabet.

Are MATANA stocks overpriced?

According to some measures like P/E ratio, MATANA stocks like Tesla, Amazon and NVIDIA are expensive. The MATANA stock price may seem steep to you as well. But tech stocks often trade at a premium since earnings are usually injected back into the company for new research and developments.

Which MATANA stocks have high analyst ratings?

All MATANA stocks except Tesla are rated as a "moderate buy" based on MarketBeat's aggregate analyst reports. You can use MarketBeat's analyst ratings screener to jumpstart your research on these stocks or others in various sectors.