Cloud software is all around us in both business and professional settings. Unsurprisingly, investing in companies that develop it has become a popular trend for both novice and experienced investors.

If you want to get your foot in the door of the cloud software space, we'll cover the different kinds of cloud computing services on offer, as well as the various investment vehicles you have at your disposal.

You'll come away with some idea of the best cloud software company stocks to invest in and a plan of action for getting started.

What Are Cloud Computing Services?

Cloud computing services encompass a variety of technology stacks for the end user. It is a model for enabling ubiquitous, on-demand access to a shared pool of configurable computing resources (e.g., networks, servers, storage, applications, and services).

The tech's long history stretches back to the 1970s with the impetus of network-based computing. Since then, individuals, governments and the private sector have implemented it into their IT infrastructures. The United States uses the Federal Cloud Computing Strategy to help drive high-level adoption of cloud stacks and applications.

You can break down cloud computing services into three main categories, namely, infrastructure as a service (IaaS), platform as a service (PaaS) and software as a service (SaaS):

- IaaS: One of the most popular forms of cloud computing by implementation, it provides virtualized computing resources over the internet. Examples of IaaS include Amazon Web Services (AWS) and Microsoft Azure.

- PaaS: PaaS allows users to design and build online applications for private and commercial purposes. Examples of PaaS include Google App Engine and Heroku.

- SaaS: SaaS is used by millions of users worldwide and across various industries. Industries that use SaaS can range from finance to consumer goods and more. At its core, SaaS allows for applications to reside on a server and then be accessed by users anywhere. Some examples include Office 365 and Google Applications.

Benefits of Cloud Infrastructure Services

Cloud infrastructure can benefit companies implementing it as part of their technology stacks. One of the most significant benefits is that it can help them save money in capital outlays and reduce their personnel and other overhead costs.

Another benefit is that it can help the company scale up or down quickly and efficiently meet changing needs. Additionally, cloud computing services provide reliability and availability. They are backed up by multiple data centers and designed to resist unexpected failures.

The largest benefit for the end user comes down to the convenience factor. Users anywhere in the world and at any time of day can access apps built on a SaaS model, for example, which can help boost user satisfaction and retention.

Ways to Invest in Cloud Computing Companies

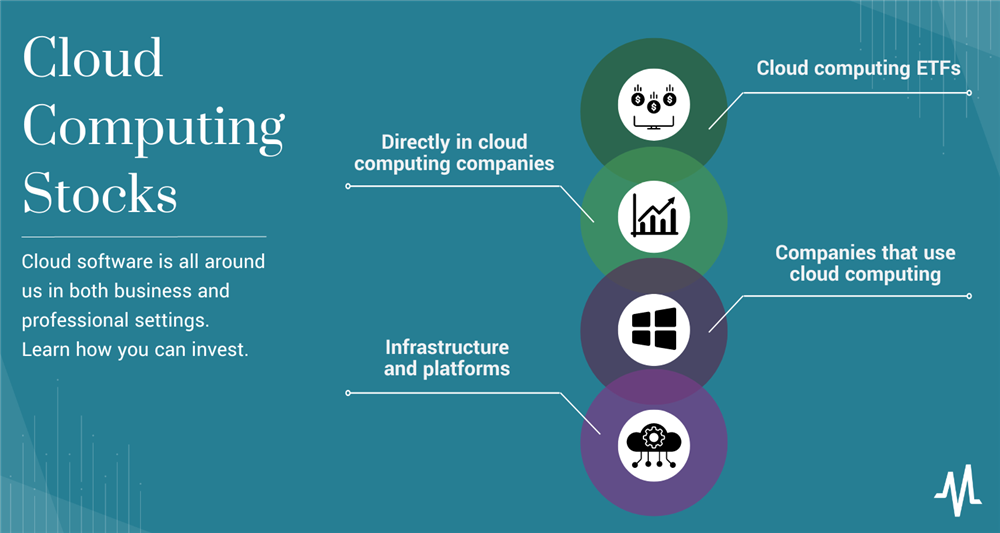

Here are some ways you can invest in companies in the cloud computing space.

Invest Directly in Cloud Computing Companies

One of the easiest ways of getting your foot in the door into the cloud space is by buying ownership in cloud computing stocks. Most people can acquire stocks of these companies through an exchange such as the NASDAQ. Investing directly in cloud companies' stock can be a great way to get exposure to the sector and benefit from business growth.

You can also invest in cloud computing infrastructure and platforms. For example, you could invest in server hardware, cloud storage solutions or SaaS cloud-based stocks. Investing in the infrastructure and platforms that cloud computing companies rely on helps gain exposure to the industry.

Invest in Companies that Use Cloud Computing

You can also invest in companies that use cloud computing. These companies leverage cloud-based software to help users become more productive and operate a suite of collaboration and data analysis tools such as Microsoft Teams and Microsoft Azure.

Invest in Cloud Computing ETFs

Cloud computing exchange-traded funds (ETFs) track the performance of companies engaged in cloud computing-related activities and services. These ETFs offer investors exposure to a range of cloud computing subsectors, including software, hardware, services and infrastructure.

Cloud computing is a rapidly expanding market and there are many opportunities to invest in companies involved in cloud computing. Whether you are an individual investor or a more prominent investor looking to diversify your portfolio, you can take advantage of plenty of options.

Investing in Cloud Computing Stocks

Investing in top cloud companies will be the go-to method for most investors to break into the cloud computing space. Buying stocks via exchanges is highly accessible and can be done by people of virtually all experience levels.

If you want a higher-level overview of investing in this sector, consider reading our guide on tech stocks and how to invest in them.

Step 1: Research the sector.

The first step to successful investing is to research the sector thoroughly. Analyzing cloud computing stocks will help you to understand the industry, the companies involved and the overall market trends. Some good places to start looking include general research reports by analysts on the cloud space and the Journal of Cloud Computing, which provides an excellent high-level overview of the industry and read through some hints for the best tech stocks to buy now.

Step 2: Identify companies.

Once you've done your research, you should be able to identify cloud space stocks you want to invest in. Look for companies with strong fundamentals, a large market share and a solid track record of success. Know the stocks' valuations, which you can measure through price-to-sales (P/S) and price-to-earnings (P/E) ratios.

The general idea is that you'd like to spot potentially undervalued stocks in the market with solid fundamentals. Read here to find undervalued stocks to invest in for some pointers.

Also, look out for recent cloud IPOs. These companies have all recently gone public and can offer great opportunities. One caveat is that the additional upside also comes with the risk of losing some or all of your initial investment.

Step 3: Analyze the market.

Analyzing the market can help determine whether it's a good time to invest in cloud computing stocks. The cloud market will likely grow to $1,025.7 billion by 2028, giving it a compound annual growth rate (CAGR) of 15.80%.

You can also benchmark cloud company stocks against their peers in the technology industry. Compare biotech stocks with those on your watchlist to see if they still represent good value.

Step 4: Choose your investment vehicle.

Once you've identified the companies you want to invest in, decide how you want to invest. You can purchase individual stocks, ETFs, mutual funds, or other investment vehicles. As previously mentioned, buying stocks of individual companies may be the easiest method to get your foot in the door.

Step 5: Monitor your investments.

After investing, you need to monitor your investments regularly. Keep track of your stocks and adjust your strategy to achieve your investment goals. For example, you can use a stock and portfolio screener to ensure your investments perform as anticipated.

Investing in Cloud ETFs

Cloud ETFs are exchange-traded funds that invest in companies that provide cloud computing services or products.

Some notable cloud ETFs include WisdomTree Cloud Computing Fund and the Fidelity Cloud Computing ETF. These ETFs often consist of some top-rated tech stocks to invest in and a diversified holding of other cloud shares.

When investing in cloud ETFs, be aware of the risks involved. Cloud stocks can be highly volatile, so investors should prepare for significant investment swings. It's also important to know the fees associated with cloud ETFs, as these can vary significantly between funds.

Cloud computing stocks have generally been strong performers over the last five years.

One of the most impressive performers has been Amazon (NASDAQ: AMZN), the world's largest cloud provider and owner of the Amazon Web Services (AWS) platform. Amazon has seen a surge in demand for its cloud services. Microsoft (NASDAQ: MSFT) has also seen strong performance, as demand for its Azure cloud platform has risen steadily each year.

These stocks make up part of the FAANG acronym. Learn more about FAANG stocks and how to start investing in them.

Amazon and Microsoft have beaten or kept pace with the long-term returns of the S&P 500 over the last five years. These companies are blue-chip and highly capitalized stocks that generally see slower growth rates than their smaller counterparts.

Cloud Software Continues to Expand

The cloud market is expanding rapidly and shows no signs of slowing down. We'll likely see more and more apps developed and hosted on cloud infrastructure in the future, so keep an eye on this space even if you are an inactive investor.